///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Card Savvy Mobile App

Card Savvy

Project Overview

The Problem

Credit card users get rewards like discounts, travel bonuses, and cash backs on credit card purchases. It’s hard to remember which credit cards offer the best rewards if you have multiple cards. When the rewards change every quarter or more, it’s even more difficult. Users often miss the best rewards, so they can not maximize their savings.

Differentiators

There are many wallet apps out there, but none of them tells you about your credit card rewards. Card Savvy represents a brand-new way to leverage your credit card spending in real time.

The Solution

Card Savvy helps you maximize the rewards you prefer, by advising you of the best card to use before you make a purchase.

-

Fully integrated for e-commerce and in-store shopping

-

Geo-fenced push notification alerts while shopping in-store

-

Set and meet your reward goals

-

Keep track of your all rewards programs in one place

-

Customize settings for better targeted & timed notifications

-

Search exclusive deals and earning opportunities

-

Pairs with your wallet app so you can plug & play

My Role

User Research, User Workflow, Brand Identity, Epics & Stories,

Promotional video, Wireframes, Prototypes, and Usability Testing.

Team

Lauren Hull, Kathleen Tibbetts, and Bhakti May

User Research

Before even diving into the features and the overall user experience of our product we did preliminary survey by SurveyMonkey to get a better understanding of who our users are and gather further insights about their needs and any pain points they have. These are some the key take aways from this survey:

Key Insights

• More than 82% of survey respondents applied for cards based on their rewards.

• Credit card users with more than one card may not know which offers the best rewards before they make a qualifying purchase.

• 50% of users have to check each card individually through a website to stay up to date on their rewards.

• 82% told us they had either missed out on rewards, or weren’t sure.

• More than 53% responded that they were Likely or Very Likely to use a tool that can concatenate their rewards information, display it at a glance, and provide information on the best card to use before they buy.

• We discovered that adults who make $45,000 per year or more, and who spend at least $400 per month across at least three cards,

are very likely to find this app useful and desirable.

Competitive Analysis

We did some competitive analysis, comparing features and finding out if we had any direct competitors. We looked at Award Wallet, Nerd Wallet, Google Pay and Apple Pay, to study their rewards functionalities. Apple and Google Pay did offer functionality you might expect, like housing loyalty cards and redeeming rewards, but they did not offer any of the special features we were looking for, as they were wallet apps. Our real differentiating features were the ability to notify users of their earnings potential in real time, based on location, rewards preferences, and goals.

Epics & Stories

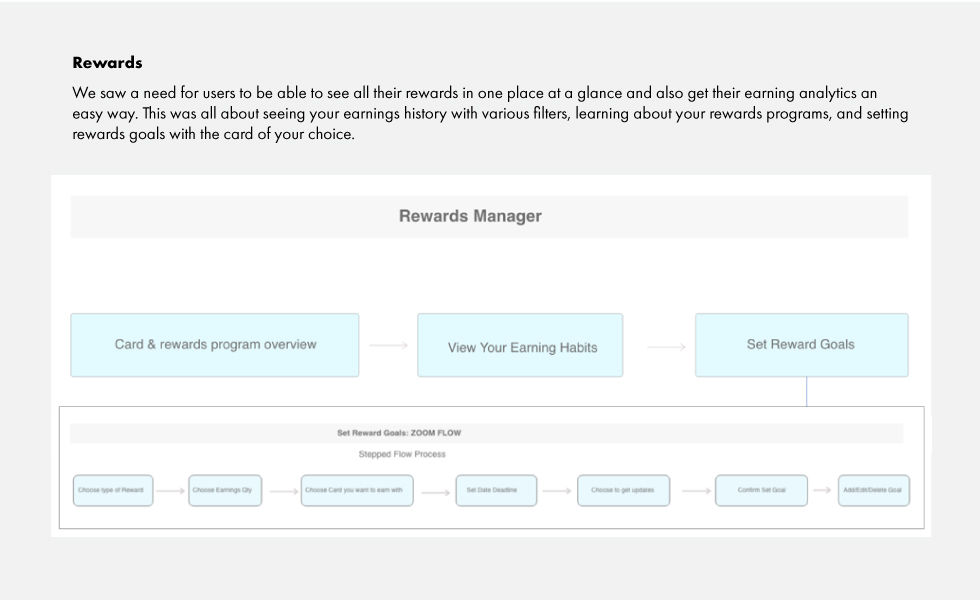

These are some of our more prominent epics and stories. Epics are those overarching large user needs to be broken into smaller, more

actionable user stories to translate into our functionalities. This was like an empathy exercise, where we would hypothesize users

needs and wants in using an app. The Settings, rewards goals, and Rewards pages ended up becoming our more primary pages.

User Workflow

Wireframes

Usability Testing

Our group ended up with two viable prototype designs. Moderated remote tests measured the effectiveness of the home screen, Rewards Tracking and Goal-Setting flows. Preference testing gave us valuable clues to the design elements users preferred.

What Worked

-

Design looks clean and purpose-built.

-

Users loved that the app will give automatic recommendations, yet still allow them to flip through and make their own choices.

-

They also enjoyed the breakdown of reward earnings by types of purchases.

What Broke

-

Some users expected the summary screens to look more like the card statements generated by their bank.

-

A user wanted a recommend card for every reward type, and a way to set goals for each card from its own page.

UI Animation

Future Features

-

Automatically time-box goal deadlines for offers that expire, so users aren’t setting a long-term goal for a short-term deal.

-

Create a way for users to donate rewards to charity via the app.

-

Allow the addition of gas, department store and other retail cards that offer rewards or loyalty programs.

-

Use predictive analytics to add promotions for new credit cards based on user rewards preferences.